Original Article Date Published:

Article Date Modified:

Help support our mission—donate today and be the change. Every contribution goes directly toward driving real impact for the cause we believe in.

In the waning days of 2025, as global financial publications released their annual rankings, a striking contradiction emerged. Portugal topped several performance tables, but Israel, a country engaged in a devastating, multi-front war for more than two years, secured a place among the best-performing advanced economies. The Economist ranked it near the top of the rich world. GDP growth outpaced many OECD peers. The Tel Aviv stock market surged by more than 50 percent. Venture capital rebounded. Mega-deals closed.

On paper, it was resilience.

But the financial surge coincided with, and critics argue was materially linked to, Israel’s sustained military assault on Gaza. What unfolded over 2025, and continued into 2026, was not simply wartime endurance. It was the expansion of a war economy in which weapons systems, AI targeting platforms, autonomous drones, and surveillance technologies were refined through live deployment, and then monetised globally.

The war economy did not operate in parallel to the destruction. It fed on it.

From Battlefield To Balance Sheet:

Israel’s tech ecosystem, long intertwined with its military establishment, accelerated its defence-AI pivot during the Gaza campaign. The Israel Innovation Authority described 2025 as a year of “inflexion,” with deep-tech investment, particularly in defence, artificial intelligence, robotics, and cybersecurity, overtaking more traditional sectors.

Startup Nation Central reported more than $111 billion in capital activity in 2025. The headline deal was the $32 billion acquisition of Wiz by Google, one of the largest exits in Israel’s history.

But beneath the civilian-facing cybersecurity narrative, defence-aligned technologies surged:

- Autonomous drone swarms

- AI-based battlefield data analytics

- Real-time facial recognition

- Robotics for tunnel warfare

- Precision-guided munitions systems

Defence contractor Elbit Systems reported record backlogs exceeding $25 billion in 2025, with revenues rising amid expanded exports to Europe and Asia. Rafael Advanced Defence Systems similarly expanded international contracts.

These were not abstract market trends. Many of the systems marketed as “combat-proven” were refined during intensive operations in Gaza.

The “First Robotics War” And The Commercialisation Of Testing:

In late 2025, Israeli defence officials described the Gaza campaign as the “first robotics war,” citing the deployment of tens of thousands of autonomous systems. AI-driven drones capable of operating in GPS-denied environments were field-tested extensively. Robotic armoured carriers entered dense urban areas. Machine-learning models were trained on real-time battlefield data.

UN Special Rapporteur Francesca Albanese had previously described the occupied Palestinian territories as a “unique testing ground” for military technologies. The events of 2025–2026 reinforced that assessment.

The testing cycle followed a rapid loop:

- Military operations created new tactical challenges, tunnels, dense civilian environments, and urban rubble.

- Startups and defence firms rapidly prototyped AI-driven solutions.

- Systems were deployed in Gaza under live-fire conditions.

- Performance data was harvested and analysed.

- Refined products were marketed abroad as battle-validated.

In investor presentations and defence expos in 2025 and early 2026, the phrase “combat-tested”, widely understood to reference Gaza, became a commercial asset.

The destruction itself became a sales credential.

2026: Expansion, Not Retrenchment.

Rather than tapering off, the defence-tech acceleration continued into 2026.

Global demand for AI-enabled military systems rose amid geopolitical tensions in Europe and Asia. Israeli firms leveraged their recent operational record to secure additional export contracts. Autonomous systems originally deployed in Gaza were adapted for border security, counterinsurgency, and urban policing abroad.

Continued deployments in Gaza during 2026 generated further testing cycles:

- AI target-recognition refinements

- Expanded drone autonomy under electronic interference

- Integrated battlefield data fusion systems

Each round of deployment produced new data streams, improving algorithms and increasing product valuation.

Stock valuations of defence-linked firms remained buoyant. Venture capital flowed into dual-use AI startups founded by former military intelligence officers. Military R&D units functioned as incubators feeding the civilian tech sector.

The feedback loop intensified.

Exporting The Laboratory:

Technologies refined during Gaza operations circulated globally.

AI data analytics platforms linked to Palantir Technologies expanded defence and law enforcement contracts. High-performance AI infrastructure powered by Nvidia chips enabled real-time surveillance systems. Drone platforms associated with Israeli-linked venture ecosystems entered municipal police departments across the United States.

This circulation blurred the line between military occupation and civilian policing infrastructure. Tools optimised in high-intensity warfare environments entered democratic governance contexts.

Critics argue that what is normalised in conflict zones can migrate into domestic institutions with limited oversight.

Wealth Accumulation Amid Destruction:

In 2025 alone, Israeli high-tech employees received approximately $15.8 billion in cash compensation from exits and equity payouts, excluding mega-deals like Wiz. A new tech elite consolidated wealth during the height of military operations.

Yet structural contradictions deepened. Startup formation rates fell sharply compared to a decade prior. Thousands of high-tech workers reportedly emigrated between late 2023 and 2025, alongside significant outflows of high-net-worth individuals.

The economy displayed two faces:

- Short-term windfalls from defence-linked exits.

- Long-term vulnerability from talent flight and overconcentration in war-driven sectors.

Still, foreign investors continued to view Israel as a premier deep-tech hub, particularly in defence AI.

The Architecture Of Profiteering:

In 2025, Amnesty International released a briefing naming multinational corporations allegedly contributing to violations in the occupied Palestinian territories. Among them were:

- Boeing

- Lockheed Martin

- Elbit Systems

- Rafael Advanced Defence Systems

- Hikvision

- Palantir Technologies

- Construcciones y Auxiliar de Ferrocarriles

Human rights advocates argue that the destruction of Gaza is embedded within global defence supply chains, not merely as a tragedy, but as a driver of contracts, exports, and technological validation.

Journalist Antony Loewenstein described this system in The Palestine Laboratory as one in which occupation generates innovation, innovation generates export revenue, and export revenue entrenches the political incentives sustaining the system.

In 2025–2026, that model reached unprecedented financial scale.

War As Economic Infrastructure:

By 2026, Israel’s economy rested on three reinforcing pillars:

- Military operations generate data and testing environments.

- Defence-tech startups commercialising battlefield innovation.

- Global export markets reward “combat-proven” systems.

The financial press described resilience.

Human rights organisations described complicity.

Investors described an opportunity.

The underlying mechanism is difficult to ignore: sustained military operations create conditions for accelerated technological refinement, increasing export competitiveness and capital inflows, which in turn reinforce political incentives to maintain defence dominance.

War, in this model, is not simply an external shock to the economy. It functions as infrastructure.

The Ethical Reckoning:

As 2026 unfolds, Israel’s defence-AI complex remains financially robust. But legal, reputational, and political pressures are mounting. Investigations, divestment campaigns, and procurement reviews are expanding in Europe and North America.

The central question confronting the global political economy is not whether Israel’s tech sector is innovative. It is whether innovation refined through large-scale civilian harm can remain politically sustainable.

For Palestinians in Gaza, the humanitarian cost has been catastrophic.

For global markets, the returns have been substantial.

For governments importing these technologies, the long-term consequences are still emerging.

The laboratory continues operating.

The contracts continue to be signed.

The algorithms continue learning.

And the profits continue flowing.

Conclusion: A Profitable Catastrophe:

By the close of 2026, the numbers remain dazzling. Israel’s deep-tech ecosystem is capitalised, export pipelines are active, and defence-linked equities remain buoyant. Venture capital continues to flow. Global investors still describe the country as a premier hub for AI-driven security innovation.

But the core question is no longer whether the model works financially.

It is whether the model works because of sustained violence, and what that means for the global system underwriting it.

The architecture now visible is not incidental. Military operations in Gaza generate operational data at scale. That data accelerates algorithmic refinement in targeting systems, autonomous navigation, pattern recognition, and predictive analytics. Refined systems are labelled “combat-proven.” Export contracts multiply. Revenues rise. Share prices strengthen. Political leverage deepens. The next funding round closes.

The cycle repeats.

In this structure, devastation is not merely a byproduct of war; it becomes integrated into the innovation pipeline. Civilian neighbourhoods reduced to rubble double as real-world R&D environments. Dense urban displacement produces stress tests for robotics and AI systems that no laboratory simulation can replicate. The longer the conflict endures, the more comprehensive the dataset becomes.

This is what makes the current moment historically significant. The Israeli defence-tech sector is not simply selling weapons. It is exporting a model, a vertically integrated ecosystem in which occupation, technological experimentation, venture capital, and global security markets operate in lockstep.

The global complicity is equally structural. Multinational defence giants supply components. Semiconductor manufacturers power AI processing. Cloud providers host military data. Western pension funds hold defence equities. Municipal police departments adopt “battle-validated” tools. Governments that condemn humanitarian devastation simultaneously sign procurement contracts.

The market does not register civilian death as a liability unless it produces regulatory risk. In fact, in many instances, escalation signals opportunity.

And yet the apparent boom conceals fragility. An economy heavily concentrated in defence exports and AI militarisation is dependent on sustained geopolitical instability. Its innovation engine increasingly draws from a narrow pipeline tied to military intelligence networks. Startup formation has slowed. Talent flight continues. Wealth concentration intensifies. What appears as resilience may in fact be short-term capitalisation on crisis.

The greater danger is normalisation.

When “combat-tested” becomes a selling point detached from the human cost of that combat, ethical boundaries erode. When autonomous systems refined in densely populated war zones migrate into civilian policing abroad, the logic of militarisation seeps into everyday governance. When shareholders celebrate quarterly gains derived from prolonged siege conditions, the distance between battlefield and boardroom collapses.

This is the unresolved contradiction at the heart of Israel’s record-breaking 2025–2026 boom: extraordinary financial performance alongside extraordinary humanitarian devastation.

For Palestinians in Gaza, the cost has been annihilating, mass displacement, infrastructure collapse, civilian death on a staggering scale.

For global investors, the period has delivered outsized returns.

For importing governments, it has offered cutting-edge security tools.

But history has a way of recalculating profit differently than markets do.

If the current trajectory continues, the legacy of this boom will not be defined solely by IPO valuations or exit multiples. It will be defined by whether the international system allowed a war economy, refined through the destruction of a besieged population, to entrench itself as a permanent pillar of global technological progress.

The laboratory is still operating.

The capital is still flowing.

The algorithms are still learning.

The question that remains is whether the world is willing to confront what, exactly, they are learning from, and who is paying the price.

For the most vulnerable people in society, the elderly pensioners facing a prolonged stay in

AFRICA/DARFUR – Clashes erupted over the weekend in the strategic border town of Tina (also

In the waning days of 2025, as global financial publications released their annual rankings, a

BIRMINGHAM/SMETHWICK, UK – A murder investigation has been launched after a young man was fatally

Mike Huckabee’s statements to Tucker Carlson reveal a systematic alignment of US diplomacy with maximalist

LINCOLN, UK – Stephen Conway, the Bishop of Lincoln, was arrested by Lincolnshire Police on

In a landmark 6–3 ruling that reasserted Congress’s constitutional control over taxation, the US Supreme

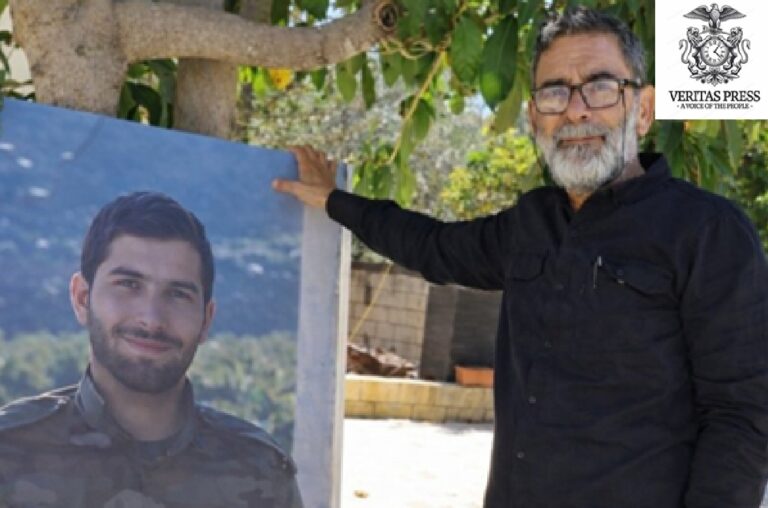

In the border village of Tallousa in southern Lebanon, 62-year-old Ahmed Turmus received a phone

The first Friday of Ramadan at Al-Aqsa Mosque has always been a barometer for tensions

A growing international outcry over the health of jailed former Pakistani prime minister Imran Khan