Title: Trump Launches $12 Billion Critical Minerals Stockpile To Counter China: Project Vault And The Geo-economic Cold War.

Press Release: Veritas Press C.I.C.

Author: Kamran Faqir

Article Date Published: 02 Feb 2026 at 15:50 GMT

Category: Americas | Politics | Trump Launches $12 Billion Critical Minerals Stockpile To Counter China: Project Vault And The Geo-economic Cold War

Source(s): Veritas Press C.I.C. | Multi News Agencies

Website: www.veritaspress.co.uk

Business Ads

Washington, D.C. / Beijing / Nuuk — In a sweeping new economic and industrial strategy, U.S. President Donald Trump has launched an unprecedented $12 billion stockpile initiative, Project Vault, designed to secure critical minerals, propel American manufacturing, and blunt what policymakers describe as China’s monopolistic grip on essential industrial metals.

Rare earths are an important tool in advancing AI, health care and defence. (Reuters)

Described by senior administration officials as the first-of-its-kind strategic reserve for the civilian economy, the project combines roughly $1.67 billion in private capital with a $10 billion loan from the U.S. Export-Import Bank (EXIM) to procure, stockpile, and distribute minerals needed across multiple sectors, from electric vehicles to advanced defence systems.

Beneath the surface of this seemingly technocratic plan lies a far-reaching industrial and geopolitical confrontation, exposing vulnerabilities in U.S. supply chains, the limits of market-led decoupling, and sharp ideological differences over global economic governance.

Project Vault: More Than A Stockpile, A Strategic Gamble.

Project Vault is explicitly modelled on the Strategic Petroleum Reserve, but instead of crude oil, it focuses on lithium, nickel, cobalt, gallium, and rare earth elements, materials critical to batteries, semiconductors, telecoms, aerospace, and national defence.

Under the arrangement:

- EXIM Bank provides a 15-year, $10 billion loan, the largest in its history, underpinning the stockpile.

- Private investors contribute $1.67 billion, with participation from more than a dozen major auto, tech, aerospace, and industrial firms, including General Motors, Stellantis, Boeing, Corning, GE Vernova, and Google.

- Commodities trading houses such as Hartree Partners, Traxys North America, and Mercuria Energy Group are tasked with sourcing and purchasing minerals.

- Participating firms commit to offtake agreements, buying minerals at pre-set prices while paying carrying costs, in what officials describe as a stabilising mechanism against price volatility.

- The reserve is positioned as an emergency buffer, capable of sustaining roughly 60 days of critical mineral supply for key sectors in the event of geopolitical disruption.

Financial markets reacted swiftly: shares of domestic rare earth and critical mineral producers, including USA Rare Earth, United States Antimony, Critical Metals, and MP Materials, all jumped, reflecting optimism that government support and long-term offtake contracts could accelerate domestic demand.

The U.S.–China Supply Chain Vulnerability:

China currently dominates global rare earth mining and processing, controlling roughly 70% of mine output and up to 90% of processing capacity, creating a structural vulnerability for Western manufacturers.

Recent Chinese export curbs and trade tensions have reinforced this risk. In 2025, Beijing enacted export restrictions on several rare earths amid tariff disputes, jolting global supply and forcing manufacturers to seek alternatives.

Goldman Sachs analysts have warned that breaking China’s rare earth monopoly could take a decade, given China’s dominance over refining and magnet production, critical choke points for EVs, semiconductors, and defence systems.

An executive involved in the project told Reuters:

“Project Vault is a national insurance policy. But the hard work comes after the metals are in the warehouse. You need processing plants, magnets, and skilled labour to turn potential into real independence.”

Trump’s Rhetoric: Industrial Nationalism Meets Geopolitics.

Trump has long framed U.S.–China competition as an existential struggle for economic and technological supremacy. Project Vault is officially cast as a countermeasure to Chinese “price manipulation and supply leverage”, linking the initiative to past export curbs that triggered U.S. production slowdowns.

In October 2025, Republican senators described China’s actions as “an economic declaration of war”, calling for robust U.S. responses, including strategic mineral stockpiles.

Trump allies and lawmakers emphasise Project Vault as both an industrial tool and geopolitical signal, sending Beijing the message that the U.S. will no longer tolerate strategic dependence on foreign materials essential for modern technologies.

China’s Position: Stability And Sovereignty, Not Zero-Sum Decoupling:

A staff member works on an automated lithium-ion battery production line at a workshop of Zhejiang Shineway Technology Co Ltd in Yongkang, Zhejiang province, China, November 11, 2025. China Daily via REUTERS Purchase Licensing Rights

Beijing maintains that it supports the stability of global critical mineral supply chains, asserting that export controls are lawful and consistent with international norms.

A January 2026 foreign ministry spokesperson said:

“China sees global minerals supply as a shared responsibility. U.S. claims of intentional manipulation are misleading.”

Chinese authorities argue that rare earth export curbs are standard national security measures, similar to those employed in other major economies. Licenses for legitimate commercial demand are provided, but sensitive technologies are closely monitored to prevent diversion to military applications.

From Beijing’s perspective, U.S. stockpiling and decoupling efforts are destabilising, rather than constructive, signalling the strategic weaponisation of minerals by both sides.

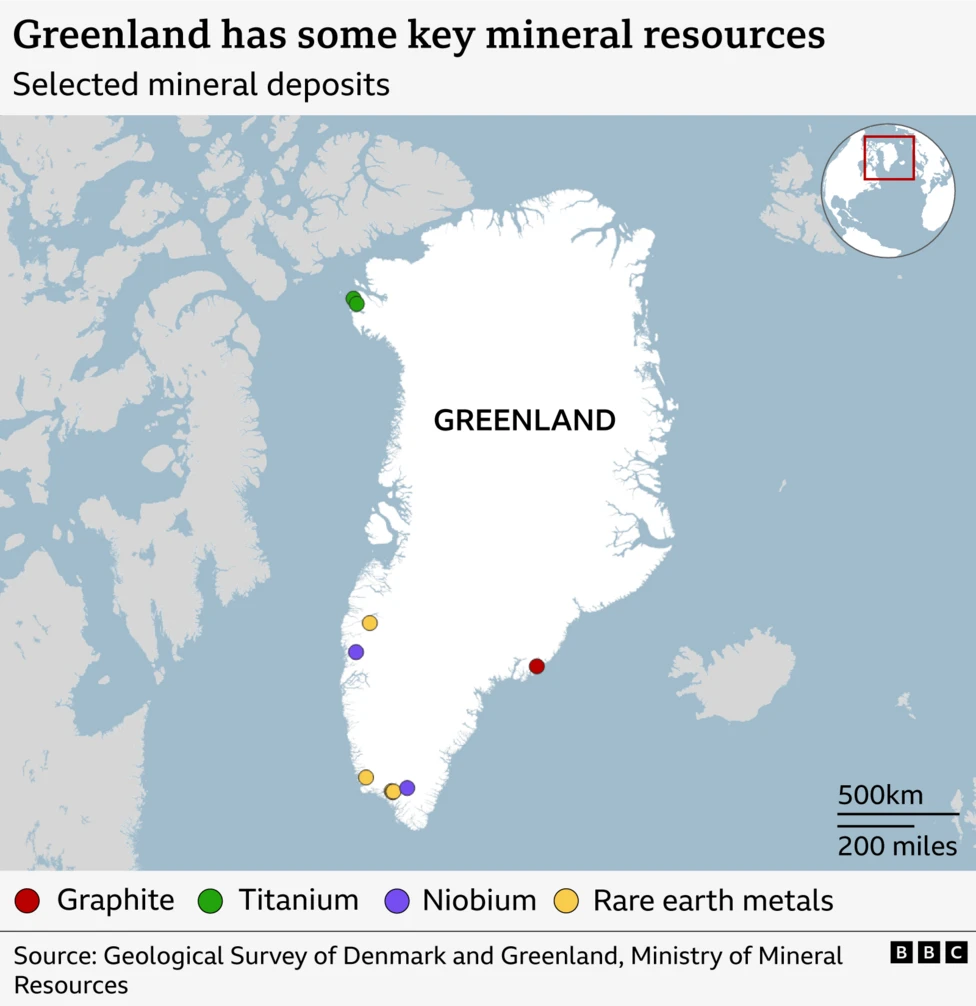

Greenland: Potential And Industrial Reality.

Trump has emphasised Greenland’s resource potential, painting the island as a treasure trove of rare earths and critical minerals. However, the reality is far more complex:

- 80% of Greenland is covered by ice up to 3,488 meters thick.

- Minimal infrastructure exists: no roads, factories, or local workforce; all supplies must be imported.

- Projects like Tanbreez, partially backed by U.S. investors including Trump family connections, remain years from commercial extraction, slowed by environmental regulations and high operational costs.

Dan Sivertsen, Secretary-General of the Greenland Business Association, notes:

“Survey teams can only work two or three months a year. Industrial-scale mining here is a long-term, high-cost gamble.”

Greenland underscores a broader truth: long-term overseas projects may supplement supply, but immediate security for U.S. industries relies on domestic stockpiling, processing, and infrastructure.

Project Vault Visual Map: Supply Chain Overview.

Project Vault: U.S. Strategic Minerals Supply Chain & Geopolitical Context

The map provides a visual overview of the strategic supply chain, mining sites, and industrial flows supporting Project Vault:

U.S. Domestic Infrastructure:

- Stockpile locations near Detroit, St. Louis, and West Coast ports

- Processing facilities: MP Materials, USA Rare Earth, other domestic refineries

- Offtake industries: auto, aerospace, semiconductors (GM, Boeing, Corning, GE Vernova, Google)

- Flow arrows: mines → EXIM-financed stockpiles → manufacturers

Greenland Mining Potential:

- Key deposits: Tanbreez (dysprosium, terbium), Kvanefjeld (yttrium, uranium)

- Status indicators: colour-coded for active, permitting halted, and future potential

- Challenges: overlay of ice coverage (80%) and minimal infrastructure

- Trump connection: U.S. investors’ involvement, Arctic shipping lanes

China’s Critical Role:

- Mining & refining regions: Inner Mongolia, Jiangxi

- Global production dominance: 70% mining, 90% refining, near-total magnet production

- Export control timeline: 2025 curbs, dual-use restrictions

Global Supply Flows:

- Imports to the U.S. from Australia, Canada, Greenland, and Southeast Asia

- Allied cooperation nodes: Australia, Japan, the EU

- Bottlenecks: South China Sea, Arctic shipping lanes

Industrial & Defence Applications:

- Sector icons: EV batteries, jet engines, semiconductors, telecom, defence systems

- Flow arrows: stockpile → industry → products

- Emergency buffer: 60-day emergency drawdown capability

Annotations & Key Stats:

- Total investment: $12 Billion

- Private vs. EXIM share: $1.67B / $10B

- Greenland potential and timeline

- China’s dominance stats

- Trump quote: “Project Vault is a national insurance policy.”

Strategic Implications And Criticism:

Project Vault anchors critical supply chains and provides a buffer against geopolitical shocks, yet analysts caution that stockpiling alone cannot solve structural weaknesses.

China’s control over refining, magnet production, and midstream technology means the U.S. must invest in processing plants, recycling, workforce development, and allied cooperation to achieve real independence.

Domestic critics warn of potential market distortions, inflated prices, and misallocation of capital, while industry advocates stress long-term investment in domestic capabilities as essential for the initiative to achieve its strategic goals.

The Bigger Picture: A New Era Of Strategic Resource Competition.

Project Vault is emblematic of a broader geoeconomic contest:

- Allied nations, including Japan, Britain, and Australia, are expanding cooperation on critical mineral supply chains.

- Bilateral U.S.–China negotiations continue, sometimes easing export curbs, but structural tensions remain.

- Breaking China’s dominance will require years of investment, innovation, processing capacity, and coordinated industrial policy, beyond the stockpile itself.

Conclusion: Industrial Policy Meets Geopolitical Contestation.

Project Vault represents a historic escalation in U.S. efforts to rebalance global critical mineral supply chains. By leveraging public-private financing and aligning industry commitments, the Trump administration aims to create a strategic buffer, catalyse domestic production, and signal resolve to Beijing.

Yet, whether the stockpile will materially shift long-term supply resilience, or become another costly warehouse of commodities, depends on parallel investments in processing, refining, allied cooperation, and a viable domestic industrial ecosystem.

As one analyst summarised:

“You can stockpile metals, but without factories, refineries, and skilled labour, you’re only storing potential, not independence. Project Vault is a necessary first step, but the race for supply chain security is a decade-long endeavour.”

The contest over minerals, once an obscure domain, now sits at the heart of 21st-century geopolitical rivalry, with profound implications for technology, defence, markets, and global power structures.

Our universe does host life, but another one might be even better suited for life.

The humanitarian catastrophe in Gaza is more than a regional crisis. It is the visible

Washington, D.C. / Beijing / Nuuk — In a sweeping new economic and industrial strategy,

LONDON — Former UK ambassador to the United States Peter Mandelson has resigned from the

In a case that has sent shockwaves through communities and law enforcement, a 26-year-old man

A widening confrontation between Israel and the international humanitarian sector is exposing what aid groups,

During the World Economic Forum in Davos last week, Elon Musk called human aging a

On 25 January 2026, the eve of India’s 77th Republic Day, a brutal episode of